Social security tax calculator 2021

Social Security website provides calculators for various purposes. The tool has features specially tailored to the unique needs of retirees receiving.

Self Employment Tax Calculator For 2021 Good Money Sense Income Tax Preparation Self Employment Business Tax

Multiply that by 12 to get 50328 in.

. Self-employed persons pay 124 for Social Security and 290 for Medicare on 9235 of net earnings. Since 147000 divided by 6885 is 213 this threshold is. If you have a combined income but are filing as an individual your benefits arent taxed if your benefits are below 25000.

Between 25000 and 34000 you may have to pay income tax on. The estimate includes WEP reduction. Use this calculator to see.

You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. Tax deferred retirement plans tend to increase tax liability on social security benefits. See What Credits and Deductions Apply to You.

Social Security Tax Changes for 2013 - 2022 High incomes will pay an extra 38 Net Investment Income Tax as part of the new healthcare law and be subject to limited deductions and. About Us Whether youre protecting your loved ones or growing your assets youre highly invested in your financial future. For 2022 its 4194month for those who retire at age 70 up from 3895month in 2021.

A The portion of income between 32000 and 44000 is taxed according to the pre-93 rules at 50 amounting to 6000 of taxable social security. If your income is above that but is below 34000 up to half of. Though Medicare tax is due on the entire salary only the first 147000 is subject to the Social Security tax for 2021.

For the 2022 tax year which you will file in 2023 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security. If SS benefit exceeds 34K then taxable portion is 85 of your SS benefits. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator.

Ad Enter Your Tax Information. Employer and employee both pay 62 for Social Security and 145 for Medicare. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

And so are we. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. While they are all useful there currently isnt a way to help determine the ideal financially speaking age at which.

SS benefit is between 232K 44K then taxable portion is 50 of your SS benefits. Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity. Will your social security benefits be taxable.

Must be downloaded and installed on your computer. Use Our Free Powerful Software to Estimate Your Taxes. For 2021 the first 142800 of your.

When you purchase life and retirement. The rate consists of two parts. So benefit estimates made by the Quick Calculator are rough.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. For 2017 the OASDI FICA tax rate is set at 62 of earnings with a cap at 127200 in 2018 this will be increasing to 128400. The maximum Social Security benefit changes each year.

The HI Medicare is rate is set at 145 and has no earnings. Get the most precise estimate of your retirement disability and survivors benefits.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Self Employment Tax Calculator For 2021 Good Money Sense Self Employment Money Sense Tax

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Using Guard And Reserve Retirement Calculators To Estimate A Reserve Pension Retirement Calculator Retirement Guard

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Fresh Blank Business Check Template Word Template Printable Payroll Template Word Template

2020 2021 Tax Estimate Spreadsheet Income Tax Capital Gains Tax Tax Brackets

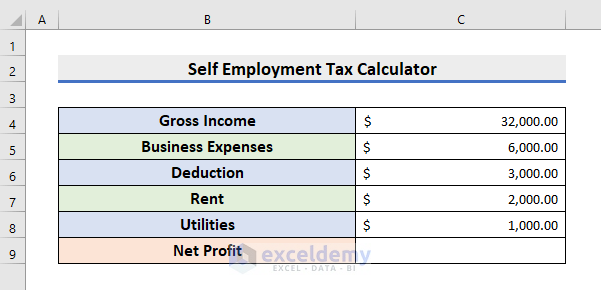

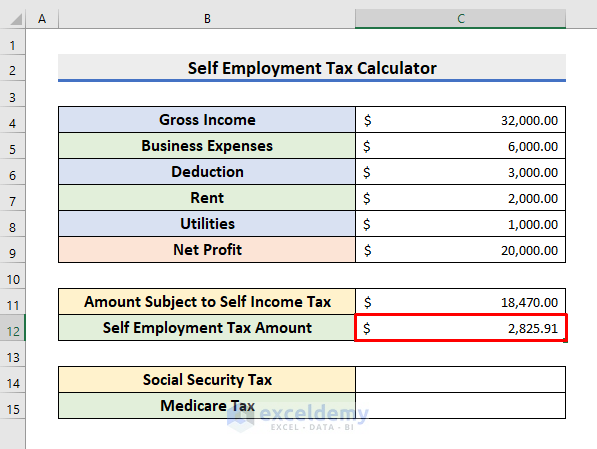

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

How To Create An Income Tax Calculator In Excel Youtube

2021 2022 Income Tax Calculator Canada Wowa Ca

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Ontario Income Tax Calculator Wowa Ca

Social Security Benefits Tax Calculator

Social Security Benefits Tax Calculator

Pin On Spreadsheets

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps